IMO 2028 – A New Legislative Measure for the Decarbonisation of Shipping

By Steve Bee – VPS Group Marketing & Strategic Projects Director & Emilian Buksak – VPS Decarbonisation Advisor

On Friday 11th April 2025, the International Maritime Organization (IMO) achieved another important step towards establishing a legally binding framework to reduce greenhouse gas (GHG) emissions from ships globally, aiming for net-zero emissions by or around 2050.

The IMO Net-zero Framework is the first in the world to combine mandatory emissions limits and GHG pricing across an entire industry sector. Approved by the Marine Environment Protection Committee during its 83rd session (MEPC 83), the measures include a new fuel standard for ships and a global pricing mechanism for emissions.

These measures, set to be formally adopted in October 2025 before entry into force in 2027, will become mandatory for large ocean-going ships over 5,000 gross tonnage, which emit 85% of the total CO2 emissions from international shipping. This Net-Zero Framework will be included in a new Chapter 5 of MARPOL Annex VI.

With an estimated 900 renewable-fuel-ready vessels expected to be sailing the seas by 2030, it is felt necessary to implement global regulation to deliver renewable fuels at a commercially viable price, as current pricing for “green fuels” is 3-4 times the price of fossil fuels. Such regulations will make it possible for ships to operate on green fuels and also incentivise fuel and energy providers to invest in new production capacity.

Under the draft regulations, ships will be required to comply with:

1. Global fuel standard: Ships must reduce, over time, their annual greenhouse gas fuel intensity (GFI) – that is, how much GHG is emitted for each unit of energy used. This is calculated using a well-to-wake basis, meaning total emissions are measured from fuel production through to its use on board.

2. Global economic measure: Ships operating above GFI thresholds will need to acquire remedial units to balance their excess emissions, while those using zero or near-zero GHG fuels or technologies will be eligible for financial rewards for their lower emissions profile.

3. Two-tier Compliance Targets: Each ship will have to meet both a Base Target and a Direct Compliance Target for its annual GFI. Vessels that stay under the stricter Direct Compliance Target are eligible to earn surplus units, whereas those over the thresholds face a compliance deficit that must be remedied.

4. Data Collection & Reporting: Operators must calculate and report their attained annual GFI each calendar year, verifying it against their target annual GFI. This includes rigorous recordkeeping and submission to the IMO GFI Registry, which tracks each vessel’s emissions performance and any remedial or surplus units.

5. IMO Net-Zero Fund Contributions: Ships that exceed their GFI limits are required to make GHG emissions pricing contributions to the new IMO Net-Zero Fund. Collected revenues will be used to reward ships using zero/near-zero fuels, support research and technological innovation in cleaner shipping, and help ensure a just and equitable transition for the maritime sector.

Net-Zero Framework Implementation and Green Balance Mechanism

From 2028 to 2030, ships will be subject to a tiered levy linked to their well-to-wake (WtW) carbon intensity. Based on a 2008 baseline of 93.3 gCO₂eq/MJ (the industry average in 2008), operators will face no charge for fuel emissions at or below approximately 77.44 gCO₂eq/MJ, a moderate levy of $100/mtCO₂eq for emissions between 77.44 and 89.57 gCO₂eq/MJ, and a higher rate of $380/mtCO₂eq for emissions exceeding 89.57 gCO₂eq/MJ. These thresholds and levies align with the overarching goal of driving down overall carbon intensity by a minimum of 4% by 2028 and 17%for direct compliance targets—with further, more stringent reductions taking effect in subsequent years.

Surplus Units and Over-Compliance

A ship’s carbon intensity below the lower threshold (77.44 gCO₂eq/MJ) constitutes “over-compliance,” generating surplus units that can be banked or traded. Conversely, exceeding thresholds will require the purchase of remedial units to cover the compliance deficit.

Sustainable Fuel Certification Scheme (SFCS) and Fuel Lifecycle Label (FLL)

Under the new framework, all fuels must carry a Fuel Lifecycle Label (FLL), which documents their GHG intensity and other sustainability attributes on a well-to-wake basis. These values must be certified by a recognized Sustainable Fuel Certification Scheme (SFCS), ensuring accurate, transparent calculations and preventing any misrepresentation of environmental impact.

Zero or Near-Zero GHG Technologies, Fuels, and Energy Sources

Recognising the importance of incentivising advanced solutions, the regulation sets specific lifecycle emission thresholds for what qualifies as a zero or near-zero GHG (ZNZ) fuel or technology: Initial threshold (valid until 31 December 2034): ZNZ fuels must not exceed 19.0 g CO₂eq/MJ on a well-to-wake basis. Post-2035 Threshold: Starting 1 January 2035, the permissible GHG intensity tightens to no more than 14.0 g CO₂eq/MJ.

Ships adopting fuels and technologies below these thresholds can earn financial rewards through the IMO Net-Zero Fund, effectively offsetting some of the initial costs of transitioning away from conventional fossil fuels. By gradually lowering the allowable GHG intensity, the regulation encourages ongoing innovation, investment, and broader adoption of advanced, low-emission solutions across the global fleet.

Green Balance Mechanism

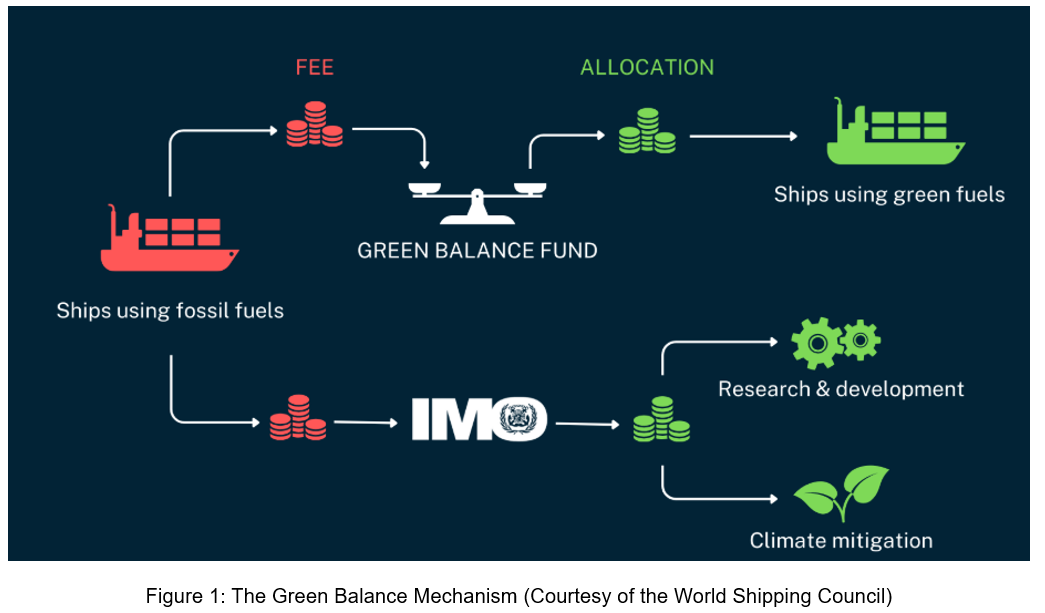

Central to this approach is the Green Balance Mechanism, which integrates closely with the GFI. In essence, it applies a fee on higher-intensity fossil fuels and allocates those proceeds to green fuels, balancing costs across a diverse energy mix. The greater the well-to-wake emission reductions a fuel delivers, the larger the financial allocation it receives—effectively levelling the playing field and stimulating a shift to sustainable alternatives.

Disbursement of Revenues

All revenues from levies and remedial unit purchases will be directed to the IMO Net-Zero Fund, which will then distribute the funds to:

- Reward low-emission ships

- Support innovation, research, infrastructure, and just-transition initiatives (particularly in developing countries)

- Fund training, technology transfer, and capacity-building aligned with the IMO GHG Strategy

- Mitigate impacts on vulnerable States, such as Small Island Developing States (SIDS) and Least Developed Countries (LDCs)

- By steadily lowering the permissible carbon intensity and introducing financial incentives for clean fuels, the new framework aims not only to reduce overall emissions but also to accelerate the maritime sector’s transition to sustainable energy solutions.

How VPS Can Help

Staying ahead of new regulatory demands isn’t just a matter of compliance—it’s a strategic move that protects both profitability and operational excellence. With industry-leading expertise in low-to-zero carbon fuel testing, advanced emissions measurement technology, and comprehensive decarbonisation software and advisory services, VPS empowers it’s customers to meet and exceed environmental targets, being uniquely positioned to guide customers through every step, ensuring accurate reporting, cost control and ongoing improvement.

1. Bunker Delivery Note (BDN) Validation & Fuel Testing

Fuel Quality & Lifecycle Analysis: VPS lead the way in marine fuel testing, developing new methodologies to provide key data on all fuel types. The past 4 years have seen major innovations and developments for biofuels and methanol testing and advisory services.

VPS validate the greenhouse gas intensity of customers fuels whether they are fossil or low-to-zero carbon fuels, based on well-to-wake standards. By analysing lifecycle GHG emissions, customers can gain confidence in their compliance numbers and avoid under- or over-reporting.

Accurate Renewable Content Measurement: Through state-of-the-art lab testing and Fuel Lifecycle Label (FLL) verification, VPS confirm the genuine renewable portion of biofuels—helping you pay the correct level of carbon taxation or remedial contributions.

Early Issue Detection: By validating BDNs and testing delivered fuel, VPS services can help prevent engine damage, unplanned downtime, and costly disputes over fuel quality.

2. Direct Emissions Measurement & Reporting

Advanced Monitoring Systems (e.g., Emsys and ShoreLink): These systems provide real-time emissions data, allowing customers to track their vessel’s GHG Fuel Intensity (GFI) and compliance status in one seamless workflow.

Data Accuracy & Transparency: Automatic digital data transfer ensures vessel emissions records are consistent, easily auditable, and ready for both internal use and external verification.

Timely Remedial Actions: With up-to-the-minute reporting, operators can make course or speed adjustments to keep emissions in check, reducing the likelihood of expensive remedial unit purchases.

3. Operational Efficiency & Advisory

Fuel Selection & Hybrid Solutions: VPS experts help match the right fuel to each vessel’s operational profile, whether that’s low-carbon or near-zero carbon fuels, blends, or hybrid setups combining LNG and batteries to reduce methane slip. This tailored approach ensures maximum efficiency and a smaller overall GHG footprint.

Power Generation & Predictive Maintenance: VPS advisors optimize power distribution to cut fuel usage and enhance system reliability. By conducting in-depth fuel performance analysis, its possible to detect early engine abnormalities, enabling proactive maintenance that prevents costly repairs and downtime.

SEEMP Updates & Crew Training: VPS provide step-by-step guidance in incorporating new regulations into Ship Energy Efficiency Management Plan (SEEMP). Additionally, we train vessels’ crew on best practices that build a culture of efficiency, helping our customers reduce emissions and comply with evolving GHG limits.

4. Net-Zero Fund & Market Mechanisms

Remedial & Surplus Units: Understand how to acquire remedial units (if GFI thresholds are exceeded) and capitalise on surplus units or zero-/near-zero fuels to earn financial rewards.

Cost-Benefit Analysis: VPS Advisory team helps the evaluation process when purchasing or trading units is beneficial versus investing in cleaner technologies or optimising operations.

Strategic Positioning: Tap into VPS insights on emerging market mechanisms to stay ahead of future pricing changes and incentives that could shift the competitive landscape.

5. Long-Term Decarbonisation Roadmaps

Holistic Compliance Planning: Whether preparing for EEXI, CII, or the IMO’s Net-Zero Framework, VPS design future-proof strategies that keep the fleet competitive for the long haul.

Integrated Training & Engagement: From onboard crew training to management briefings, VPS ensures everyone understands the regulations, the rationale behind them, and how to maintain best practices.

Continuous Improvement: VPS advisory goes beyond periodic check-ins; by partnering with our customers regarding ongoing performance reviews, data benchmarking, and the identification of new efficiency measures.

Next Steps

Formal adoption of the IMO Net-Zero Framework is scheduled for October 2025, with entry into force by 2027. However, preparation must start now to avoid last-minute risks, manage costs effectively, and stay ahead of competitors.

If you’d like to assess your vessel’s readiness or explore how to optimize your operations under the new rules, please get in touch with our decarbonisation advisory team at: Emilian.buksak@vpsveritas.com

We’re here to help you convert regulatory pressure into practical advantages—keeping you compliant, cost-effective, and resilient for the future.

Search

Search

Customer

Customer